Reduce Insurance Claims with TrackN’s Driving Behaviour & Telematics Data

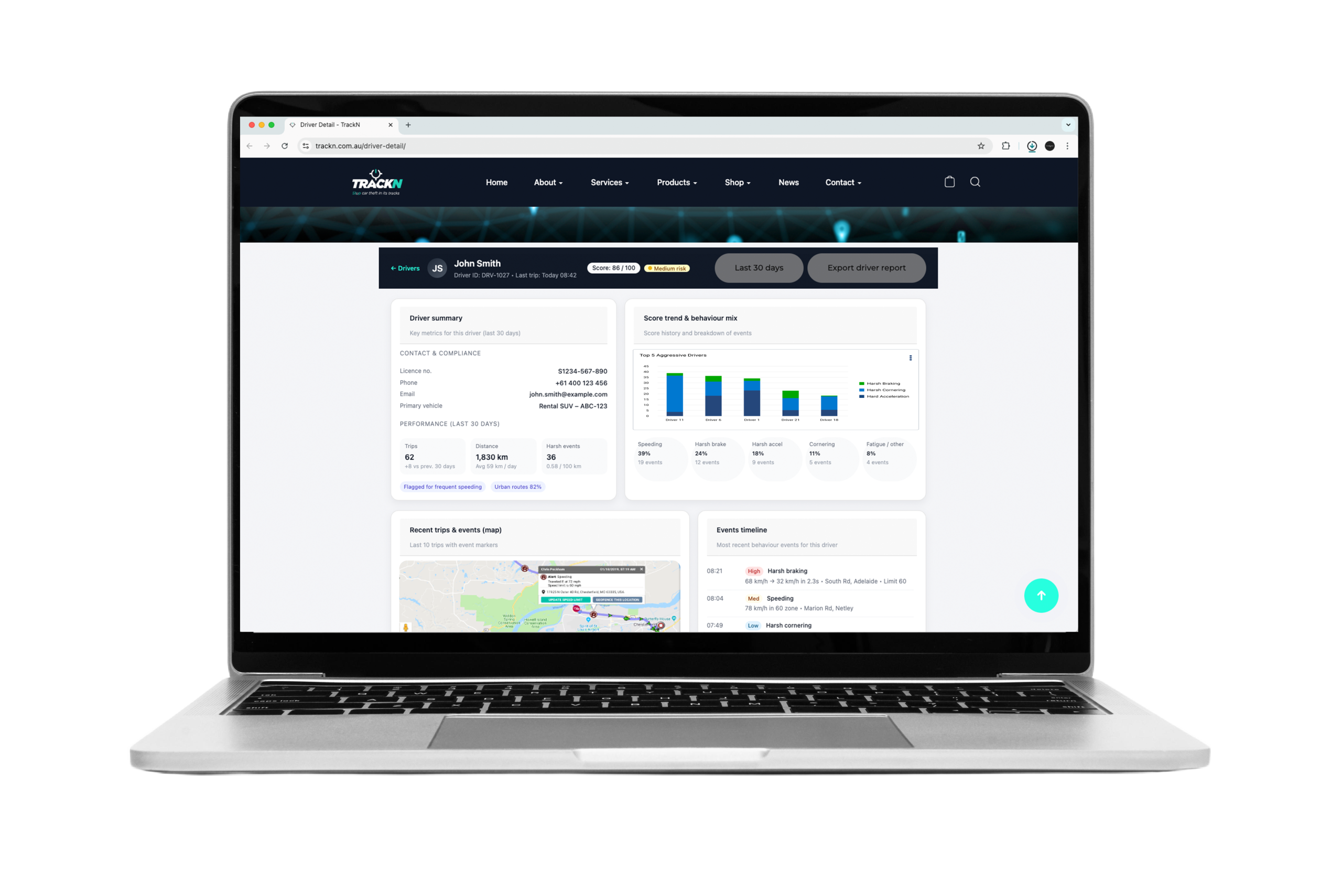

High-risk driving behaviour is one of the leading causes of insurance claims, vehicle accidents, and fleet losses in Australia. TrackN’s advanced driving behaviour monitoring system, powered by GPS telematics, gives insurers and fleet operators real-time insight into how vehicles are actually being driven — helping reduce risk, prevent accidents, and significantly lower claim frequency.

TrackN provides integrated solutions including GPS tracking, fleet monitoring and remote engine immobilisers designed for insurers, rental companies and high-value asset owners.

What is Driving Behaviour Monitoring?

TrackN’s system uses GPS tracking, telematics sensors, accelerometers and AI analysis to monitor, record and score driving behaviour in real time.

Tracked behaviours:

-

Harsh braking events

-

Rapid acceleration patterns

-

Harsh cornering behaviour

-

Speeding violations

-

Dangerous route deviations

-

Excessive idling & fatigue indicators

-

After-hours or unauthorised vehicle use

-

Location, time & trip verification

-

Driver risk scoring

Each driver is given a dynamic driving risk score, helping insurers assess real-world risk instead of assumptions.

How TrackN Reduces Insurance Claims

1. Accident Prevention Through Early Detection

By identifying unsafe behaviour early, TrackN allows intervention before accidents occur, reducing:

-

Collision risk

-

At-fault accidents

-

Vehicle damage

-

Injury claims

Fewer accidents = fewer claims = lower premiums.

2. Enables Usage-Based & Behaviour-Based Insurance

TrackN’s data supports modern usage-based insurance (UBI) models, allowing insurers to:

-

Reward safe drivers with discounts

-

Penalise risky patterns

-

Improve underwriting accuracy

-

Increase customer retention

3. Provides Verified Accident & Claim Evidence

TrackN captures:

✅ Exact speed

✅ Braking & impact force

✅ Location & route history

✅ Timestamped evidence

This helps to:

-

Fight fraudulent claims

-

Resolve disputes quickly

-

Support legal investigations

-

Protect insured drivers

4. Reduces Fraud & Unauthorised Use

TrackN detects:

-

After-hours misuse

-

Vehicle theft

-

Unauthorised movement

-

Tampering or disconnection attempts

This lowers insurance exposure significantly.

5. Improves Driver Accountability

Businesses can use TrackN to:

-

Identify high-risk drivers

-

Deploy training programs

-

Track improvement

-

Set policy compliance standards

Result: Safer fleets and fewer claims.

Industries That Benefit

-

Insurance companies

-

Rental car agencies

-

Transport & logistics fleets

-

Construction & mining companies

-

Government & council vehicles

-

Luxury / high-value vehicles

TrackN scales from 1 vehicle to 100,000+ vehicles.

TrackN Telematics Reporting Includes:

-

Live GPS map dashboard

-

Driver behaviour scoring

-

Incident & collision reports

-

Monthly performance summaries

-

Insurance-ready reports

-

API and system integration

-

White-label insurer dashboards

Learn more: 👉 https://trackn.com.au/fleet-tracking